The Bible speaks a great deal about money, and the Book of Proverbs specifically teaches us about saving, avoiding debt, contentment, budgeting, and working hard. We are, after all, called to be good stewards of what God has entrusted to us. Unfortunately being good stewards can get complicated when determining policy on the global scale.

As we move increasingly toward a global economy, the idea around work and commerce both domestically and around the world, raise the awareness of exchanging goods and services on a much larger scale. Trading resources have been a way of exchange since Genesis 2 when God provided food from the Garden in exchange for the ‘simple’ request that careful avoidance be used when the temptation arises to eat from one of the trees. Clearly, the ‘deal’ was not honored by Adam and Eve and negative consequence ensued. Later, after the flood God scattered the people around the world and the expansion of the economy took root, “From the sons of Noah came the people who were scattered over the whole earth (Genesis 9:19)”.

Comparative Advantage

Today, the ability of a person to produce goods and services at a lower opportunity cost is referred to as comparative advantage. Putting it another way, comparative advantage allows the farmer to most efficiently produce large quantities of vegetables, while the cattle rancher may efficiently produce large quantities of milk and meat. By bringing these two individuals together, they can trade vegetables for milk and meat, and vice-versa. Since the days in the Garden, the world has become a place of decay and scarcity. We have to be good managers of the limited resources that are made available in a market economy.

Tariffs and Today’s Challenges

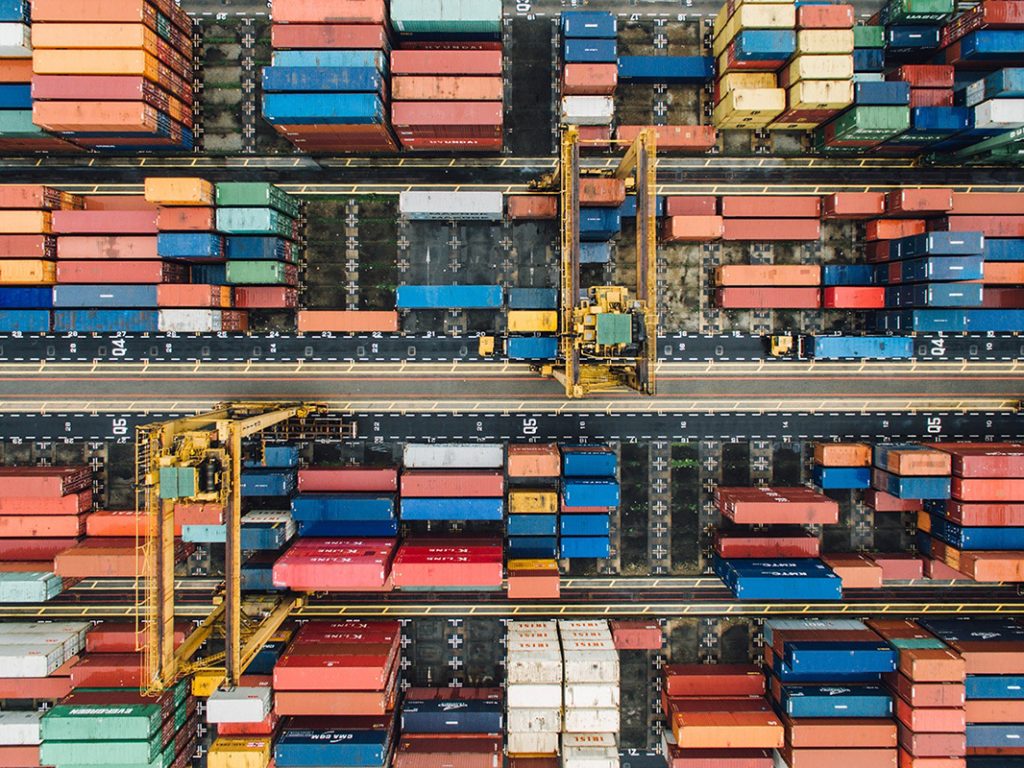

Fast forward to 2018 and our current environment of global commerce. The United States, European Union, and China are the three largest economies in the world. Leveling the playing field in regards to economic trade can be a complicated initiative. Economies this large need fair and efficient systems of exporting and importing goods and services in order to grow and stay healthy, which is where tariffs come into play. Tariffs, which are essentially a tax, are used to restrict imports by increasing the price of goods and services purchased from overseas and making them less attractive to consumers compared to what may be available via domestic production.

Governments may impose tariffs to raise revenue or to protect domestic industries—particularly blossoming ones—from foreign competition. By making foreign-produced goods more expensive, tariffs can make domestic-produced ones more attractive. By protecting these industries, governments can also protect jobs. Tariffs can also be used as an extension of foreign policy: imposing tariffs on a trading partner’s main exports is a way to exert economic leverage. Tariffs can also have unintended side-effects. They can make domestic industries less efficient by reducing competition. They can also hurt domestic consumers, since a lack of competition tends to push up prices.

Renegotiating Deals

Our current President (Trump) has lauded himself as a “deal-maker” and has taken his negotiating approach to the Presidency. Whether it’s trade deals, political deals, peace in the Korean peninsula, or international tariffs, Donald Trump appears to be looking at reevaluating many of the negotiations previously made with the United States. Trump’s background before politics was primarily as a real-estate developer in a tough New York market so his perspective and approach to running the United States looks much like his approach to running his business. Negotiating deals that provide benefit for his company, or in this case, the United States appears to be an important initiative.

Since being elected, Trump has talked about renegotiating the, “bad deals” made in the past with NAFTA (North American Free-Trade Agreement), the European Union, and China. What he claims to be bad for the United States with unfair trade imbalances, Trump is seeking to change with more productive, long-term agreements.

Reacting to Rhetoric

What we’ve been seeing in the news lately are stories calling the U.S. (or Trump) a bully; absurdity that the U.S. would punish Europe and Asia with high tariffs; a ‘hard to win’ trade war; and calls to protect industries like steel and livestock. I believe that the short term volatility will eventually regress to stability once much of the rhetoric and negotiating finishes. The rhetoric is typically due to each country wanting to negotiate the best deal they can get while Trump has said that it’s necessary for the U.S. to “rebalance” trade with Europe, Asia, and other nations.

For the remainder of 2018 and possibly into early 2019, it’s likely we’ll see the markets continue to react with high volatility in the short term as they attempt to find price stability within the global trade imbalances (steel, aluminum, fruits, vegetables, livestock, etc.). According to an article from Marketwatch.com, futures prices for steel have risen about 39% year to date, which is, “good news for anyone who produces steel in the United States”.

Tariffs can be effective to protect US trade interests; however, they can also be preventative in trade with other countries if too extreme. What I see happening now is the United States spotlighting existing trade deals with China, Canada, Europe, and others as a way to shed light and bring attention to many of these formerly negotiated deals.

the big picture is that global economies have much to gain and lose. However, it is my opinion that renegotiating trade deals on a more frequent basis should be welcomed by all as the global economy is constantly changing.